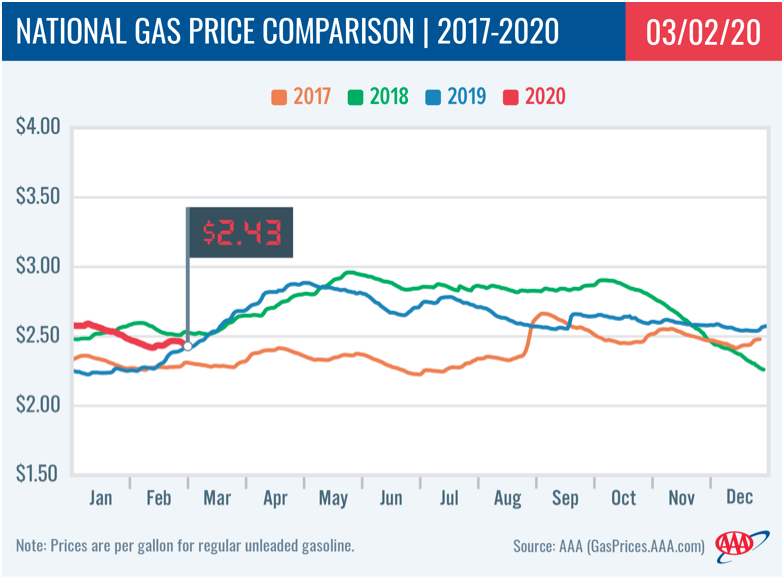

At $2.43, the national gas price average is just one penny more expensive than gas prices at this time last year. Gas prices have not been cheaper year-over-year since before Thanksgiving last November. Today’s average is also four cents cheaper than both a week and a month ago.

“Gas prices pushed cheaper year-over-year in the last 30 days, going from 22 cents to just one cent more expensive,” said Jeanette Casselano, AAA spokesperson. “Healthy stock levels and cheaper crude prices have alleviated pump price pains. However, maintenance season and the upcoming switchover to summer blend could break the downward trend in coming weeks, but we are also watching the impact of the coronavirus and what that could do to demand.”

The ability to tap into robust U.S. gasoline stocks has contributed to price declines at the pump. Stocks dipped for a second week, by 2.7 million bbl, according to the Energy Information Administration’s (EIA) latest report. Overall stock levels measure at 256.3 million bbl, which is comparable to this time last year. Demand jumped slightly above 9 million b/d.

Quick Stats

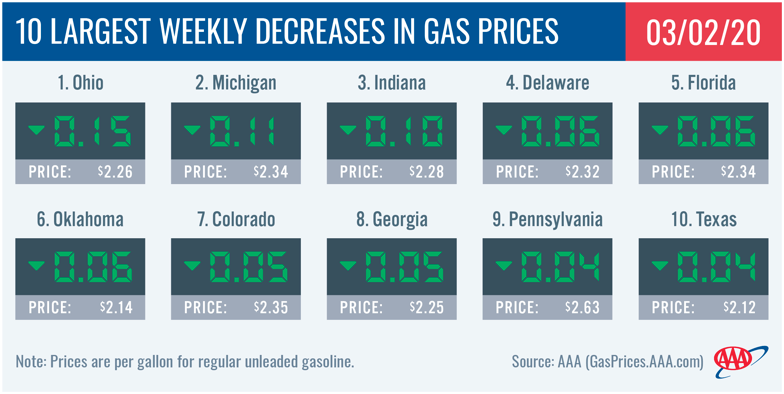

- The nation’s top 10 largest weekly decreases are: Ohio (-15 cents), Michigan (-11 cents), Indiana (-10 cents), Delaware (-6 cents), Florida (-6 cents), Oklahoma (-6 cents), Colorado (-5 cents), Georgia (-5 cents), Pennsylvania (-4 cents) and Texas (-4 cents).

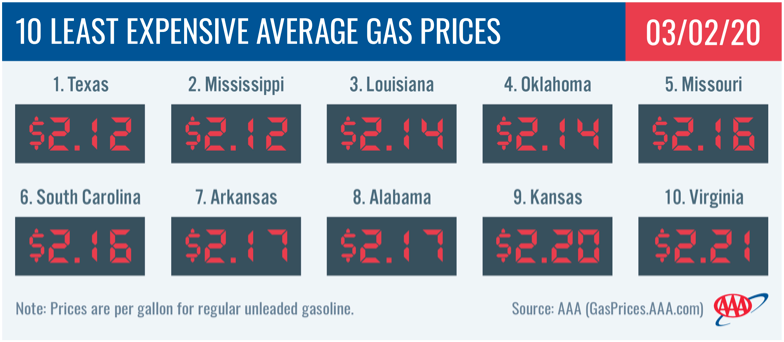

- The nation’s top 10 least expensive markets are: Texas ($2.12), Mississippi ($2.12), Louisiana ($2.14), Oklahoma ($2.14), Missouri ($2.16), South Carolina ($2.16), Arkansas ($2.17), Alabama ($2.17), Kansas ($2.20) and Virginia ($2.21).

West Coast

Pump prices across the West Coast region have mostly dropped, consistent with the end of the winter driving season. When compared to a week ago, Hawaii (-2 cents), Nevada (-2 cents) and Arizona (-2 cents) saw the largest decreases, while Alaska (+1 cent) was the only state in the region to see its average increase. Hawaii ($3.56) and California ($3.47) remain the most expensive markets in the country. Washington ($3.08), Oregon ($2.98), Alaska ($2.92), Nevada ($2.89) and Arizona ($2.75) follow.

Last week’s fire at Marathon’s 363,000 b/d Carson facility, which initial reports indicated started with a reformer in the light ends unit, did not cause a long-term pricing impact in the state or region. Moving into this week, barring any additional supply challenges, prices will likely continue to fall. According to EIA’s latest weekly report, total gas stocks in the region increased from 30.85 million bbl to 31.23 million bbl, which is 1.48 million bbl lower than the level at this time in 2019.

Great Lakes and Central States

North Dakota ($2.34) and Minnesota ($2.32) were the only states in the Great Lakes and Central region to not see gas prices decrease on the week. While most states in the region are paying just a few pennies less a gallon to fill-up, Ohio (-15 cents), Michigan (-11 cents) and Indiana (-10 cents) saw double digit decreases and rank as the top three largest weekly changes in the country.

Illinois ($2.60) and Missouri ($2.16) land on the most and least expensive top 10 lists, respectively, in the country.

As prices dipped at the pump, regional gasoline stocks held relatively steady at 59 million bbl. This healthy level amid robust refinery utilization (90%), as reported by the EIA, should help to keep gas prices stable in the week ahead.

South and Southeast

Gas prices are less expensive on the week across the South and Southeast states, which is the opposite trend from how last Monday kicked off the work week. Floridians and Oklahomans are seeing the biggest savings of six cents followed by these states, Georgia (-5 cents), Texas (-4 cents), New Mexico (-4 cents) and South Carolina (-4 cents).

The EIA reports that regional stocks saw a large 1.4 million bbl draw, which would normally be a contributing factor to pump price increases. However, given that total stocks measure at a very healthy 91 million bbl, the latest stock decline did not negatively impact gas prices. Last year, stocks in the South and Southeast only reached 90.9 million bbl at their highest point and that was in early January 2019.

Mid-Atlantic and Northeast

Four states land on the top 10 list for largest monthly change – one for an increase and three for decreases. This includes Delaware (+11 cents), which has the largest increase month-over-month in the region, while West Virginia ($2.37), Maine ($2.41) and Vermont ($2.55) all have an eight cent decrease.

On the week, gas prices are cheaper, if not stable, across the Mid-Atlantic and Northeast region with Delaware (-6 cents) and Pennsylvania (-4 cents) seeing the largest pump price drops.

Motorists in the region should brace for a week of volatility. EIA data shows regional refinery utilization decreased for another week, this time from 59% to 57%. More troublesome, stocks drew by a significant 1.4 million bbl down to 65.1 million bbl. Market analysts are closely watching the Phillips 66 265,000-b/d Bayway refinery in Linden, N.J., which went offline for maintenance about a month ago.

Rockies

Idaho (+2 cents) was one of only two states in the country where pump prices increased on the week. In the region, gas prices pushed cheaper by a nickel in Colorado ($2.36), while Utah ($2.47), Wyoming ($2.45) and Montana ($2.41) saw movement of a few pennies.

For the first time in weeks, EIA reports that regional stock levels declined. Stocks dipped by 200,000 bbl down to 9.3 million bbl total. Compared to February 2019, stocks are measuring about 2 million bbl ahead, which has helped to put downward pressure on gas for the region this winter driving season.

Oil Market Dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI decreased by $2.33 to settle at $44.76. Crude prices have not been this low since December 2018. The significant decrease in crude prices has been led by the growing impact of the coronavirus. The market continues to worry that the impact of the virus will lead to a reduction in global economic growth and global travel, with crude demand expected to decrease. Until it appears that the international public health threat from the virus decreases and China’s industrial sector recovers from the impact of the virus on production, crude prices are likely to continue facing downward pressure.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.