On the week, the national gas price average and that of 26 states jumped a nickel or more. The national gas price average has been steadily increasing for the last three weeks. During that time, gasoline stocks have gradually decreased while demand has started to increase and crude oil prices have been fluctuating. Combined, these factors are driving up gas prices across the country.

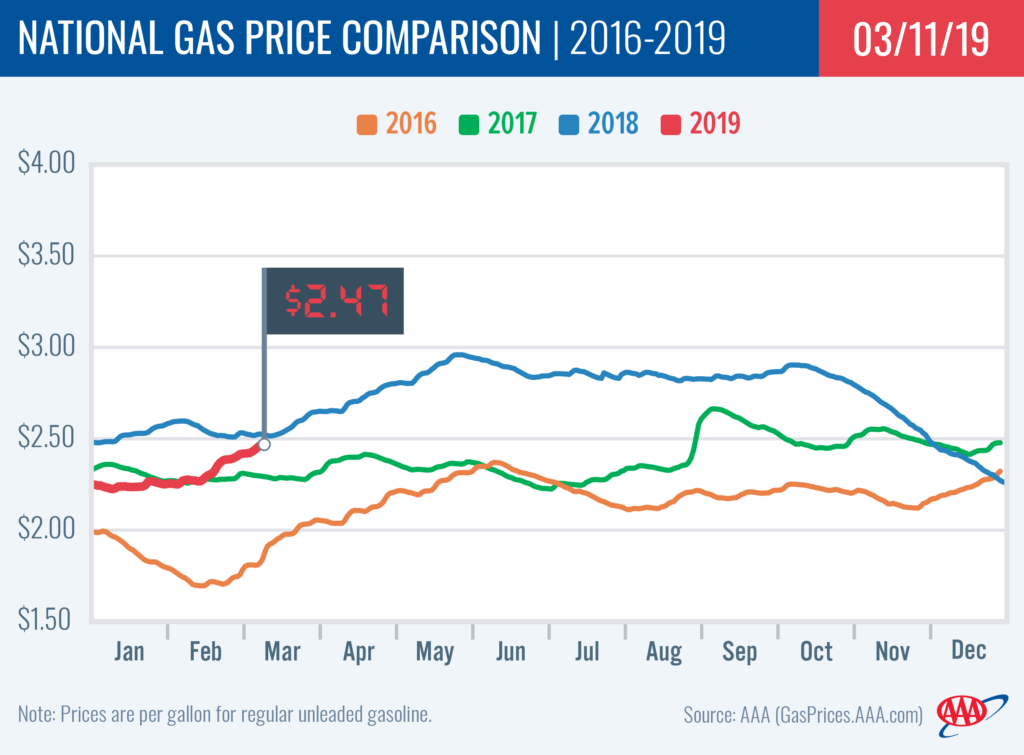

“While motorists are paying more to fill up today than at the beginning of the year, gas prices are still cheaper year-over-year by a nickel,” said Jeanette Casselano, AAA spokesperson. “Pump prices will continue to increase in coming weeks, but AAA does not expect this year’s high to be nearly as expensive as last year’s peak price of $2.97.”

Today’s gas price average of $2.47 is a nickel more than last week, 20 cents more expensive than a month ago, but five cents less than last year.

Quick stats

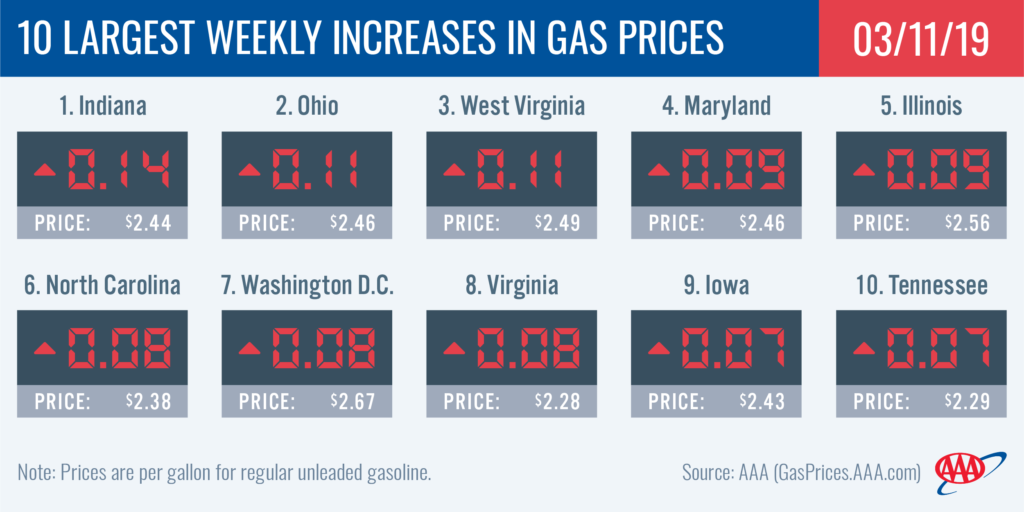

- The nation’s top 10 largest weekly increases are: Indiana (+14 cents), Ohio (+11 cents), West Virginia (+11 cents), Maryland (+9 cents), Illinois (+9 cents), North Carolina (+8 cents), Washington, D.C. (+8 cents), Virginia (+8 cents), Iowa (+7 cents) and Tennessee (+7 cents).

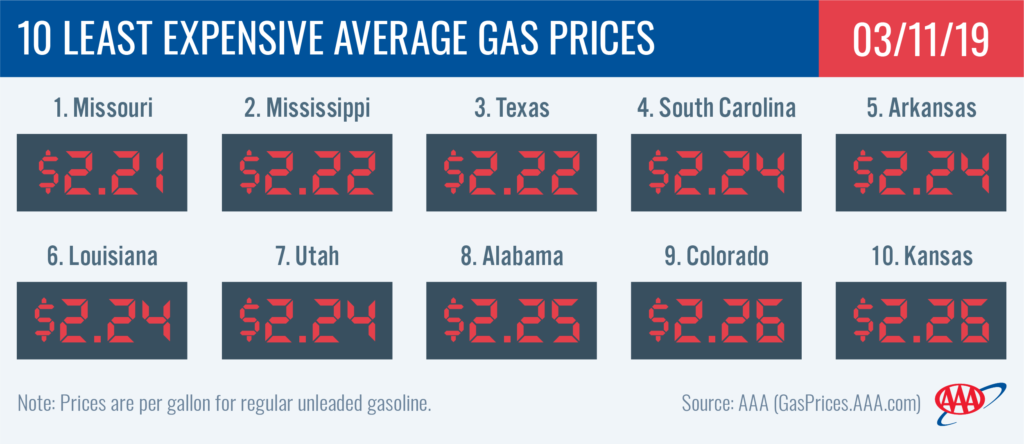

- The nation’s top 10 least expensive markets are: Missouri ($2.21), Mississippi ($2.21), Texas ($2.22), South Carolina ($2.24), Arkansas ($2.24), Louisiana ($2.24), Utah ($2.24), Alabama ($2.25), Colorado ($2.26) and Kansas ($2.26).

Mid-Atlantic and Northeast:

In the region, gas prices range from $2.28 – $2.67. As regional gasoline stocks tighten, six Mid-Atlantic and Northeast states’ gas price averages jumped seven cents or more and land on the top 10 list of largest changes in the country on the week: West Virginia (+11 cents), Maryland (+9 cents), North Carolina (+8 cents), Washington, D.C. (+8 cents), Virginia (+8 cents) and Tennessee (+7 cents).

All states have cheaper year-over-year pump prices, with these five states carrying the largest differences compared to this time last year in the region: Rhode Island (-14 cents), Vermont (-13 cents), Connecticut (-12 cents), Maine (-11 cents) and New Hampshire (-11 cents).

Since the beginning of February, regional gasoline stocks have decreased by 6.3 million bbl due to ongoing planned and unplanned refinery maintenance. As stocks diminished, total inventory tightened to 64.9 million bbl – one of the lowest levels seen in the region this year. However, year-over-year, inventories are at a 3.1 million bbl surplus, according to Energy Information Administration (EIA) data.

Great Lakes and Central States

Indiana (+14) and Ohio (+11 cents) saw the largest week-over-week gas price increases of all states in the region and the country. Joining these two states from the region on the top 10 biggest changes list are Illinois (+9 cents) and Iowa (+7 cents).

Year-over-year, gas price averages in the region are as much as 18 cents cheaper. North Dakota (-18 cents) and South Dakota (-17 cents) have the largest difference in gas prices compared to this time last year.

Gasoline stocks drew moderately in the region to total in the EIA’s latest reading at 58.3 million bbl. In the same week, regional refinery utilization decreased one percent. If stocks continue to fall, gas prices are likely to continue increasing especially with the switchover to summer-blend gasoline, which is more expensive to produce.

South and Southeast

With six South and Southeast states’ gas price averages a quarter or more expensive than last month, the region is seeing some of the largest month-over-month increases in the country: Oklahoma (+30 cents), Alabama (+28 cents), Arkansas (+28 cents), Mississippi (+25 cents), Louisiana (+25 cents) and Texas (+25 cents).

On the week, state gas price averages are as much as seven cents more expensive for all but one state. Florida (-1 cent) was the only state in the region and the country to see gas prices decrease since last Monday, albeit by only a penny

Gasoline stocks in the region decreased for a third consecutive week, though just by 220,000 bbl to total 87.2 million bbl. If stocks continue to decline, gas prices can be expected to continue to increase for motorists in the region.

Rockies Region

In contrast to recent trends, all states in the region saw gas prices jump on the week: Utah (+6 cents), Colorado (+5 cents), Idaho (+5 cents), Montana (+4 cents) and Wyoming (+2 cent). Despite pump prices trending more expensive, the region carries relatively cheap gas. Currently, Utah ($2.24) ranks as the seventh least expensive gas price average in the country while Colorado ($2.26) is 10th, Wyoming ($2.28) is 11th, Idaho ($2.34) is 18th and Montana ($2.34) is 19th.

Despite increases, Utah (-2 cents) and Wyoming (-1 cent) averages are still cheaper than gas prices a month ago, joining only Alaska and Nevada.

Gasoline stocks in the region declined for a third week, dropping to 7.3 million bbl. The tighter supply level – which is an 810,000 bbl deficit compared to this time last year – is likely contributing to the increase in prices. However, according to EIA data, refinery utilization increased from 86.9 to 91 percent which could lead to an increase in production and more supply in coming weeks.

West Coast Region

Pump prices in the West Coast region are among the highest in the nation, with most of the region’s states landing on the nation’s top 10 most expensive list. At $3.31, California and Hawaii are the most expensive markets. Washington ($2.91), Nevada ($2.84), Alaska ($2.80) and Oregon ($2.80) follow. Arizona ($2.49) is the only state in the region that dropped from the 10 most expensive markets list. All prices in the region have increased on the week, with Arizona (+7 cents), Washington (+4 cents) and Oregon (+4 cents) seeing the largest jumps.

EIA’s recent weekly report showed that West Coast gasoline stocks increased modestly by 56,000 bbl. They now sit at 32.77 million bbl. Stocks are approximately 1.6 million bbl lower than at this time last year, which could cause prices to spike if there is a supply challenge in the region this week.

Oil market dynamics

At the close of Friday’s formal trading session on the NYMEX, WTI dropped 59 cents to settle at $56.07. Oil prices fell at the end of last week following the release of lower-than-expected job growth data in the U.S. and continued concerns that a slowing global economy could bring weaker global crude demand later this year. Moving into this week, crude prices may rise as the global crude supply tightens due to OPEC’s 1.2 million b/d production reduction agreement in place through at least June 2019 and U.S-imposed crude export sanctions on Iran and Venezuela.

Additionally, EIA’s weekly petroleum report showed that total domestic crude inventories fell by 7 million bbl to 452.9 million bbl, which is 27 million bbl more than last year’s level at this time. Domestic production also hit a new all-time high record since EIA began reporting it at 12.1 million b/d. The growth in U.S. production, which is now the world’s leading crude producer, could help meet demand due to tighter supplies this year.

In related news, Baker Hughes Inc. reported that the U.S. lost 22 oilrigs last week, bringing the total to 834. When compared to last year at this time, there are 38 more rigs this year.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.