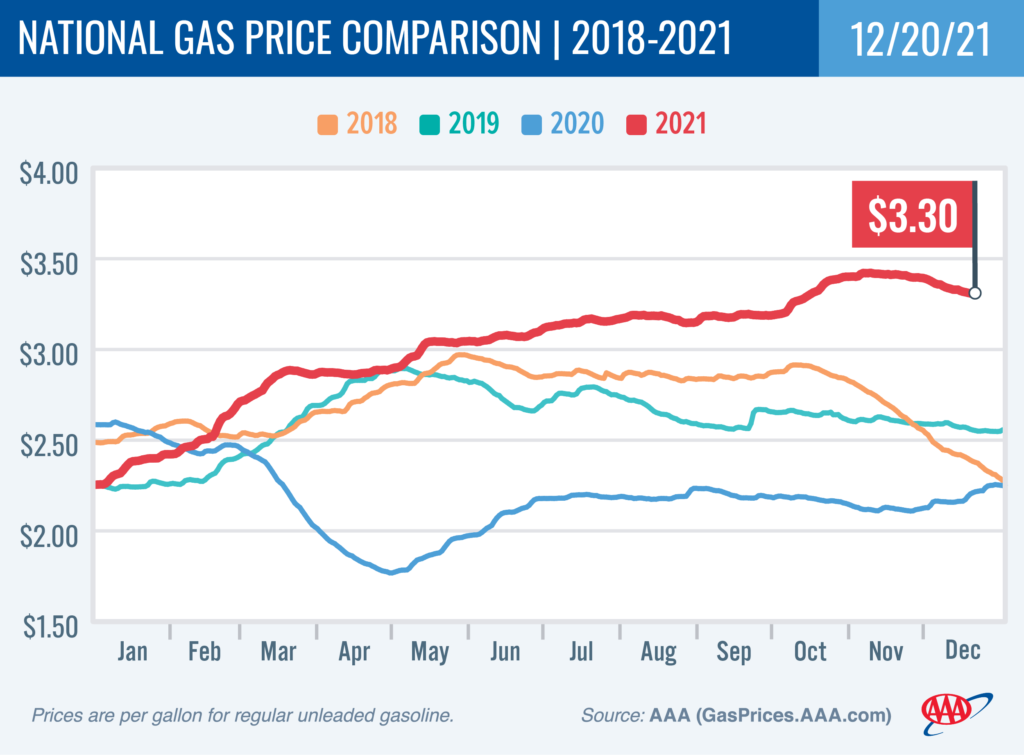

WASHINGTON, D.C. (December 20, 2021)—Gasoline demand surged last week, buoyed by increased pre-holiday consumer confidence. But fears of the COVID-19 omicron variant’s economic impact may threaten future global oil consumption. As a result, pump prices fell again last week as crude oil prices wobbled—neither rising steadily nor falling rapidly. The national average for a gallon of gas dipped three cents to $3.30.

“A recovering economy coupled with strong employment is leading to increased demand for gasoline,” said Andrew Gross, AAA spokesperson. “This demand increase should drive pump prices higher, but it’s been blunted by the wavering price of crude oil.”

According to recent data from the Energy Information Administration (EIA), total domestic gasoline stocks decreased by 700,000 bbl to 218.6 million bbl last week. Meanwhile, gasoline demand increased from 8.96 million b/d to 9.47 million b/d. Typically, growing demand and tight supply would support rising pump prices; however, fluctuations in the price of crude oil have helped to put downward pressure on prices. Last week, crude prices crept above $70 per barrel and if oil prices continue to climb, pump prices will likely follow suit.

Today’s national average of $3.30 is 11 cents less than a month ago and $1.09 more than a year ago.

Quick Stats

The nation’s top 10 largest weekly decreases: Indiana (−6 cents), Michigan (−6 cents), Ohio (−5 cents), Arizona (−5 cents), Illinois (−5 cents), Florida (−4 cents), Colorado (−4 cents), Alabama (−3 cents), Kentucky (−3 cents) and Wisconsin (−3 cents).

The nation’s top 10 most expensive markets: California ($4.66), Hawaii ($4.33), Washington ($3.86), Nevada ($3.86), Oregon ($3.77), Arizona ($3.69), Alaska ($3.69), Idaho ($3.60), Utah ($3.55) and Pennsylvania ($3.55).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI decreased by $1.52 to settle at $70.86. Crude prices declined last week due to growing market concerns that the omicron variant of COVID-19 will lead to a decrease in demand as governments around the globe increase measures to curb transmission rates. Additionally, crude prices declined despite EIA’s new data revealing that total domestic crude stocks decreased by 4.6 million bbl to 428.3 million bbl. The current stock level is 14.4 percent lower than mid-December 2020. For this week, crude prices could drop further if omicron concerns persist.

Motorists can find current gas prices by visiting the AAA Gas Price site or for planning their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.

###