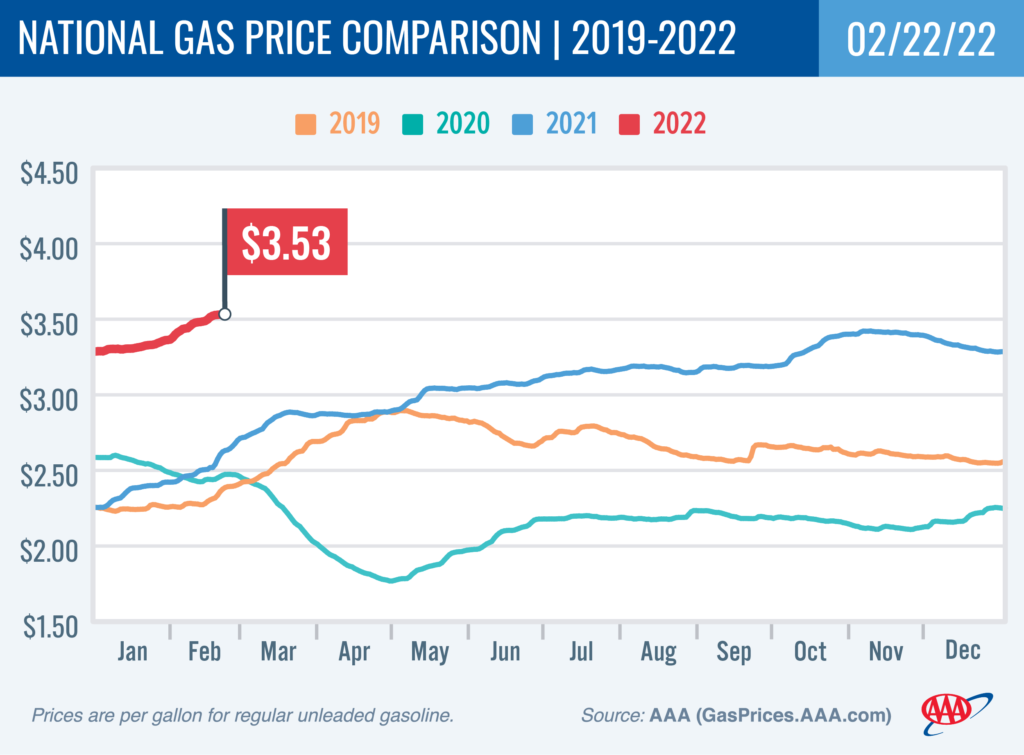

WASHINGTON, D.C. (February 22, 2022)—The potential invasion of Ukraine by Russia is having a rippling effect on the oil market, which in turn is driving up the price of gasoline in the U.S. The national average for a gallon of gas has risen to $3.53, four cents more than a week ago.

A Russian attack would be met by severe financial sanctions led by the United States and its allies. Russia will likely retaliate by withholding oil from the world market, which is already tight and struggling to keep up with demand as nations worldwide move on from COVID-related economic slowdowns.

“Russia is one of the leading oil producers globally, behind only the United States and Saudi Arabia,” said Andrew Gross, AAA spokesperson. “And if they choose to withhold their oil from the global market, such a move would eventually be reflected in higher gas prices for American drivers.”

According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks decreased by 1.3 million bbl to 247.1 million bbl last week. On the other hand, gasoline demand fell from 9.13 million b/d to 8.57 million b/d. Typically, a decrease in gas demand during the winter would put downward pressure on pump prices, but elevated crude prices continue to push pump prices higher.

Today’s national average for a gallon of gas is $3.53, which is 21 cents more than a month ago and 90 cents more than a year ago.

Quick Stats

The nation’s top 10 largest weekly increases: Ohio (+10 cents), Maryland (+8 cents), North Carolina (+7 cents), Minnesota (+6 cents), Nevada (+5 cents), Louisiana (+5 cents), New Hampshire (+5 cents), Arizona (+5 cents), New York (+5 cents) and Hawaii (+5 cents).

The nation’s top 10 most expensive markets: California ($4.74), Hawaii ($4.51), Oregon ($3.98), Washington ($3.98), Nevada ($3.95), Alaska ($3.85), New York ($3.75), Pennsylvania ($3.73), Washington, D.C. ($3.72) and Arizona ($3.71).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI decreased by 69 cents to settle at $91.07. Although crude prices declined at the end of last week due to increased market expectations that more oil could enter the global market if the U.S. and Iran complete a new nuclear agreement, and related sanctions are lifted, the tension between Russia and Ukraine contributed to rising oil prices earlier in the week. Additionally, EIA reported that total domestic crude stocks increased by 1.1 million bbl to 411.5 million bbl. The current stock level is approximately 11 percent lower than mid-February 2021, contributing to pressure on domestic crude prices. For this week, crude prices could climb if EIA’s next report shows a decrease in total stocks.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.

###