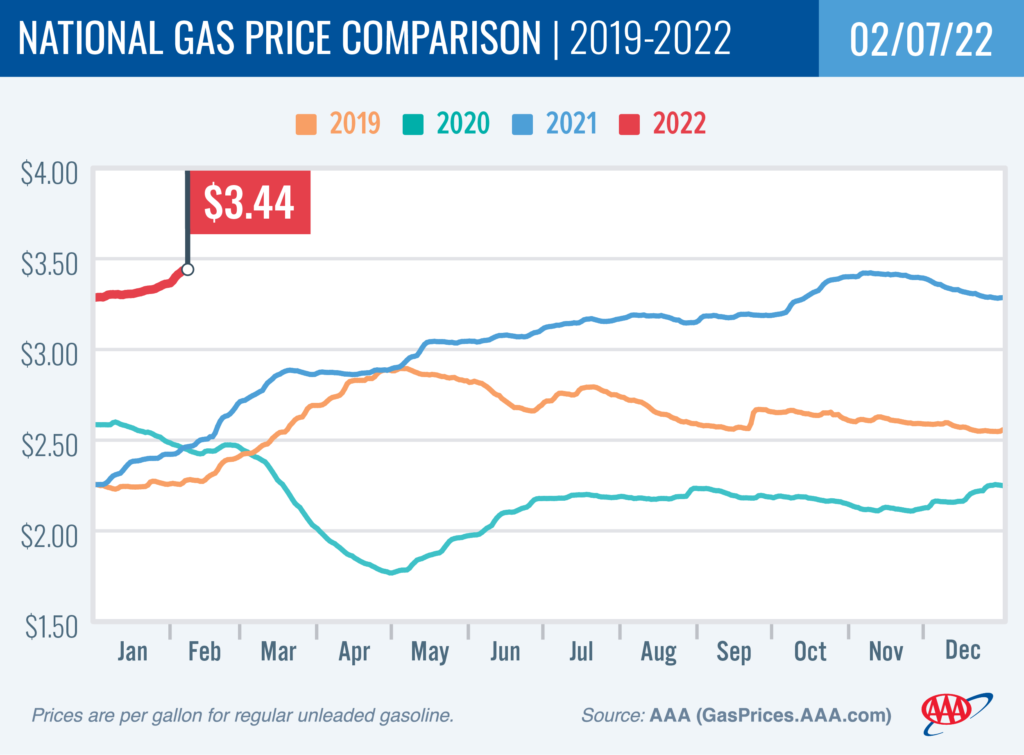

WASHINGTON, D.C. (February 7, 2022)—Blustery winter weather and geopolitical tensions are helping to drive the price of oil higher, which is in the low-$90s per barrel, nearly $30 more than in August. The recent cold weather in the U.S increased the demand for heating oil. Meanwhile, the concern that Russia will react to potential western sanctions by withholding crude oil from the already tight global market puts heavy upward pressure on prices. The national average for a gallon of gas has surged to $3.44, eight cents more than a week ago. Gas was last this expensive in 2014.

“This shows how events on the other side of the globe can have a noticeable impact right here in the U.S,” said Andrew Gross, AAA spokesperson. “And unfortunately for drivers, they are reminded of this by higher prices at the pump.”

According to new data from the Energy Information Administration (EIA), total domestic gasoline stocks grew by 2.1 million bbl to 250 million bbl last week. However, gasoline demand dropped from 8.51 million b/d to 8.23 million b/d. Usually, an increase in total stocks and a decrease in demand puts downward pressure on pump prices, but the rising cost of oil continues to push prices higher instead. If crude prices continue to climb, pump prices will likely follow suit.

Today’s national average for a gallon of gas is $3.44, which is 14 cents more than a month ago and 98 cents more than a year ago.

Quick Stats

The nation’s top 10 largest weekly increases: Michigan (+15 cents), Ohio (+14 cents), Florida (+12 cents), Indiana (+11 cents), Minnesota (+11 cents), Delaware (+11 cents), Maryland (+10 cents), Illinois (+9 cents), Wisconsin (+9 cents) and Kansas (+9 cents).

The nation’s top 10 most expensive markets: California ($4.68), Hawaii ($4.40), Washington ($3.95), Oregon ($3.93), Nevada ($3.86), Alaska ($3.78), Arizona ($3.64), Washington, D.C. ($3.62), Illinois ($3.61) and Pennsylvania ($3.61).

Oil Market Dynamics

At the close of Friday’s formal trading session, WTI increased by $2.04 to settle at $92.31. The tension between Russia and Ukraine continues to contribute to rising oil prices. Russia is a member of OPEC+, and any sanctions based on their actions toward Ukraine may cause it to withhold crude oil from the global market. Additionally, EIA reported that total domestic crude stocks decreased by 1.1 million bbl to 415.1 million bbl. The current stock level is approximately 13 percent lower than at the end of January 2021, contributing to pressure on domestic crude prices. If EIA’s next report shows another inventory decline, crude prices could continue to rise.

Motorists can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad, and Android. The app can also map a route, find discounts, book a hotel, and access AAA roadside assistance. Learn more at AAA.com/mobile.

###