All Media

Releases

With May Approaching, Pump Prices Stick to the Slow Lane

2024 AAA Car Guide – EVs Reign Supreme

Don’t Get April Fooled by Wobbling Gas Prices

Gas Prices March Higher with the Arrival of Spring

Filling Up Won’t Cost a Pot ‘O Gold This St. Patrick’s Day

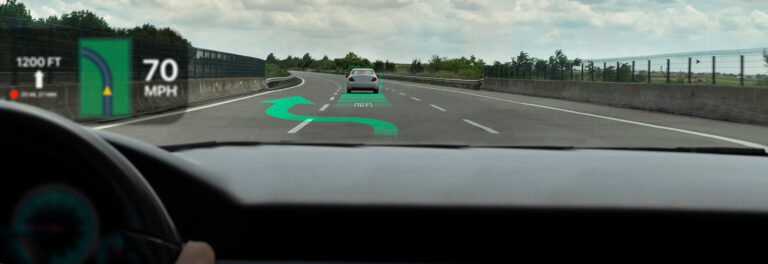

AAA: Fear of Self-Driving Cars Persists as Industry Faces an Uncertain Future

Pump It Up – Gas Prices Rise Ahead of Daylight Saving Time

The Quiet Killer Stalking Our Roads – Drowsy Driving