All Media

Releases

The 100 Deadliest Days: Teen Driver Deaths Jump in Summer Months

Ahead of Memorial Day Weekend, Gas Prices Hold Steady

AAA Elects Malcolm L. (Lee) McAllister as New Board Chair

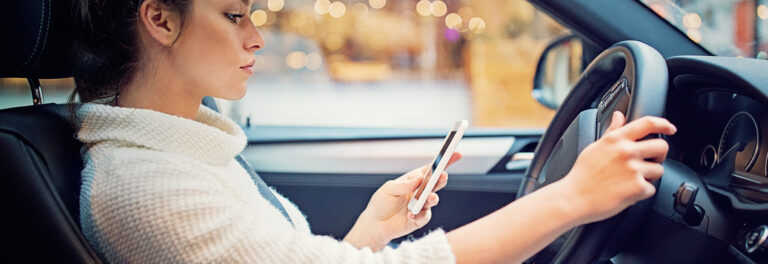

Silencing Distraction: Can this Smartphone Feature Save Lives?

In Honor of Earth Day, AAA and NAPA Team Up

2025 AAA Car Guide Winners

Do Smartphone Apps Hold the Key to Safer Drivers?

AAA Urges Drivers to Stay Proactive on Auto Repair and Maintenance